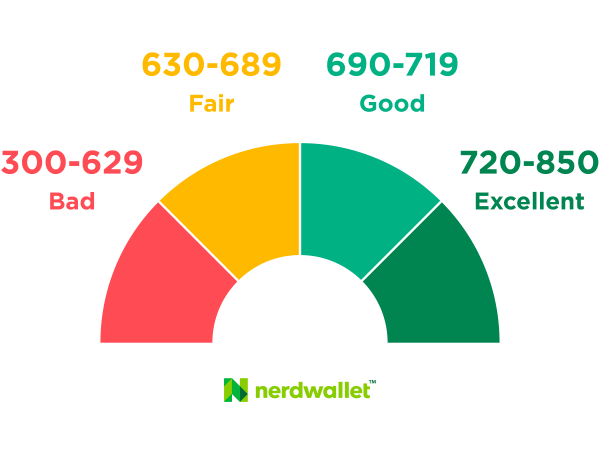

I’m not a financial guru by any means, but I do know how important a credit score is for things. A credit score is basically a number that shows how reliable you are at paying people back. Think paying back a car loan, or your mortgage, or your rent. The higher the score, the more reliable you are at paying debt and the more you can borrow.

Source: https://www.nerdwallet.com/article/finance/credit-score-ranges-and-how-to-improve

I never had a credit card until after college.

I knew that getting one only meant late payments and poor credit score.

I did everything I could do make sure my credit score was going to be solid when I got my first credit card.

To my surprise, when I applied for one my credit score was below 500.

WHAT?!

I was shocked and ended up finding out that it was nothing I did specifically. I won’t share all of the details, but essentially the reasoning I had a credit score below 500 was nothing I did and totally out of my control.

Nonetheless, I wanted to improve it and I set out to do just that.

Four years later, my credit score is sitting at around 750 and getting better each month.

Here’s how I did it:

- Got my first credit card – limit about $500

- Only spent $300 on it and only used it for what I had in the bank. Never stretched purchases. So this was typically groceries, gas, etc.

- Make every single payment each month IN FULL. Don’t just make the minimum payment, pay it of. Once again, only spend what you have in the bank.

- Created a budget (here is my budget tracker template) and stuck to it. Began to prioritize saving money each month first then spending the rest.

- After getting into a routine of saving first, spending next, I began to make two car and student loan payments each month to pay those off faster. As long as you aren’t penalized by your loaners by doing that, it helps show the credit score peeps you are trustworthy you’ll pay off your debt. Maybe you can’t do 2x the payment each month, but anything more than your standard payment is going to be beneficial.

- Focus on sticking to your budget and also increasing your salary. The more you make, the higher likelihood you can pay off loans (if you make $50k rather than $40k, you’re more like to get that $4,000 loan).

- Be patient and when you mess up, get back on track. The number one thing to NEVER mess up on is missing your monthly payment in full. Everything else has wiggle room, but missing a payment can damage your reputation quickly.

That’s it. That’s all I did and now I’m sitting here with a 750 credit score and a $19,000 credit limit on my only credit card when 4 years ago I was at sub-500 with $500 limit.

Don’t share to brag, but sharing in case anyone needs hope that a bad start can end up being a great situation if you stick to a plan and believe in yourself.